Anticipating Change

in Energy Markets

Delivering actionable insights, quality data products, and leading energy analysis since 1984.

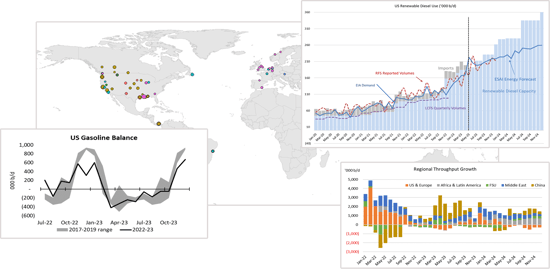

Since 1984, ESAI has been helping industry leaders and governments navigate critical transitions in the liquids energy markets. The analytical team, trained in quantitative analysis, economics, political science, finance, and industrial policy, tracks supply, demand, price, regulation, and policy to provide timely insight on developments impacting the legacy and emerging energy markets.

Our analysts collect known data and track new data sources to shed as much light as possible on the energy markets. These data are integrated with analysis of regulatory and policy developments to project how markets will unfold.

ESAI’s expertise has historically encompassed petroleum and natural gas liquids, but we have also applied our approach to renewable fuels, credit markets, and vehicle technologies in order to project the pace and scale of the handoff between legacy and emerging markets in transportation and industry.

As an independent, privately-held company, we aim to bring you a comprehensive and objective perspective on global, regional, and national energy markets by leveraging our greatest strengths:

ENERGIES

POLICY & REGULATION

FORECASTING

Whether interested in traditional or emerging energy markets, we provide an independent, data-driven analysis of output, demand, and trade on a global, regional, and selected country basis. Markets are examined within the context of macroeconomic, regulatory, and geopolitical developments worldwide to provide detailed projections of supply, demand, and price.

Our work has always integrated volumetric data with regulation, policymaking, and geopolitics. Our approach rests on a foundation of data, and integrating numbers with regulation and policy decisions makes us nimble at recognizing fundamental market change and adroit at interpreting its potential implications before others in our business do.

ESAI Energy provides forecasts of supply, demand, and price of crude and products in the liquids energy space. Our methodology rests on integrating economic, industrial, political, and regulatory analysis. Moreover, our forecasts are built from the bottom up, aggregating by product, sector, and country to develop global understanding.

-

CURATED DATA

-

HOLISTIC APPROACH

-

CUSTOMER-CENTRIC

Our analysts identify critical gaps in available data and work to add a valuable dimension to forecasts.

- ESAI Energy collects all kinds of formal data for our proprietary database that dates from 1978

- Our database is global and built from the bottom up with individual country, provincial, or state data

- Our analysts identify the gaps in available data and do the legwork to find or develop that data and bring it to you

Our cross-functional and cross-regional organization facilitates nimble, cost-effective support that generates integrated insights.

- At ESAI Energy, there are no analytical silos. Our analysts work as an integrated team to answer questions and project outcomes.

- Our analysts have specific regional and linguistic experience that allows each to have a deep understanding of socio-economic, political, and military factors that influence markets in each region

- All of our work reflects the integration of regulatory and policy developments with supply, demand, and price

Our Analyst On Demand program provides support based on your needs and timeline rather than ours—as simple as a phone call with an expert analyst. No gatekeepers. No runaround.

- Ad hoc queries

- Conference calls

- Memos and presentations

- Customized datasets are refreshed monthly

- Issue-specific executive or board presentations

What our customers are saying.

"ESAI’s analysis team, and their own executive leadership, have always been a phone call or email away to help in a bind or to make sense of questionable developments in the market."

"We could not have kept up the quality and consistency of market analysis for our department head, our CEO, Board, and the Operations team without ESAI."

"The relationship is personal, and the product suite such a great fit that you’d swear they were co-workers a few seats over."

"ESAI Energy's report analyses always have something interesting in them I didn’t know and haven’t seen elsewhere."

"Willing to customize some data to make it more useful without making you jump through hoops."

"ESAI Energy is the only firm in the industry that provides comprehensive refinery-level data."

In the news.