Petrochemicals

This monthly report consists of data and analysis that delves into the changing landscape of the petrochemical market and the dynamics of petrochemical feedstocks, including ethane, LPG, and naphtha. By analyzing market fundamentals, pricing trends, ongoing projects, and regional developments, we present a comprehensive outlook on each market individually and the sector as a whole.

We also follow developments beyond the petrochemical industry for LPG and naphtha. This includes monitoring changes in the residential/commercial and transportation sectors, considering consumer behavior, seasonal patterns, government policies, and climate mandates. These factors significantly affect the petrochemical sector and will remain a key analysis area. Accompanying the new report is an expanded dataset that encompasses information on ethane, propane, butane, and naphtha.

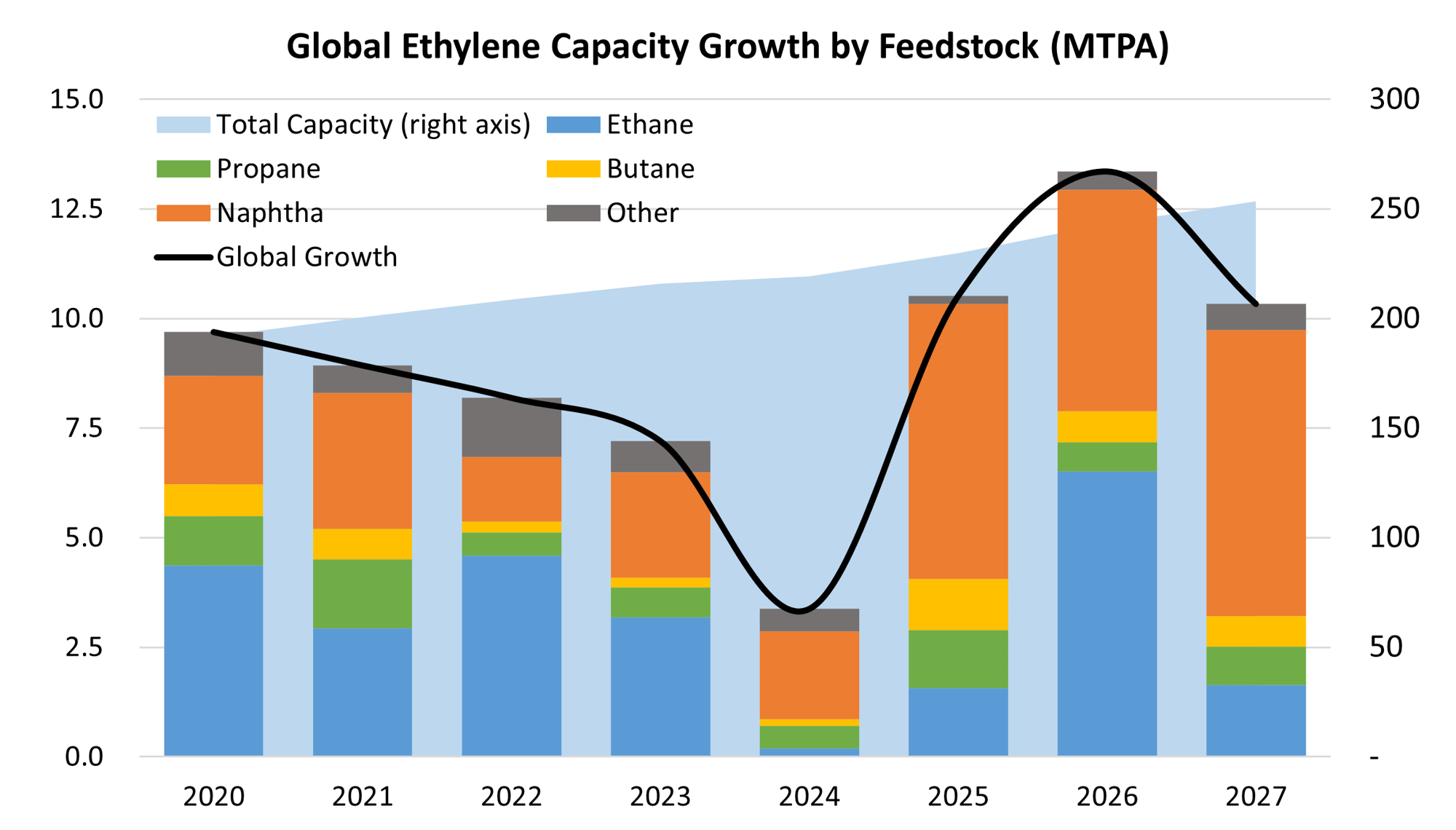

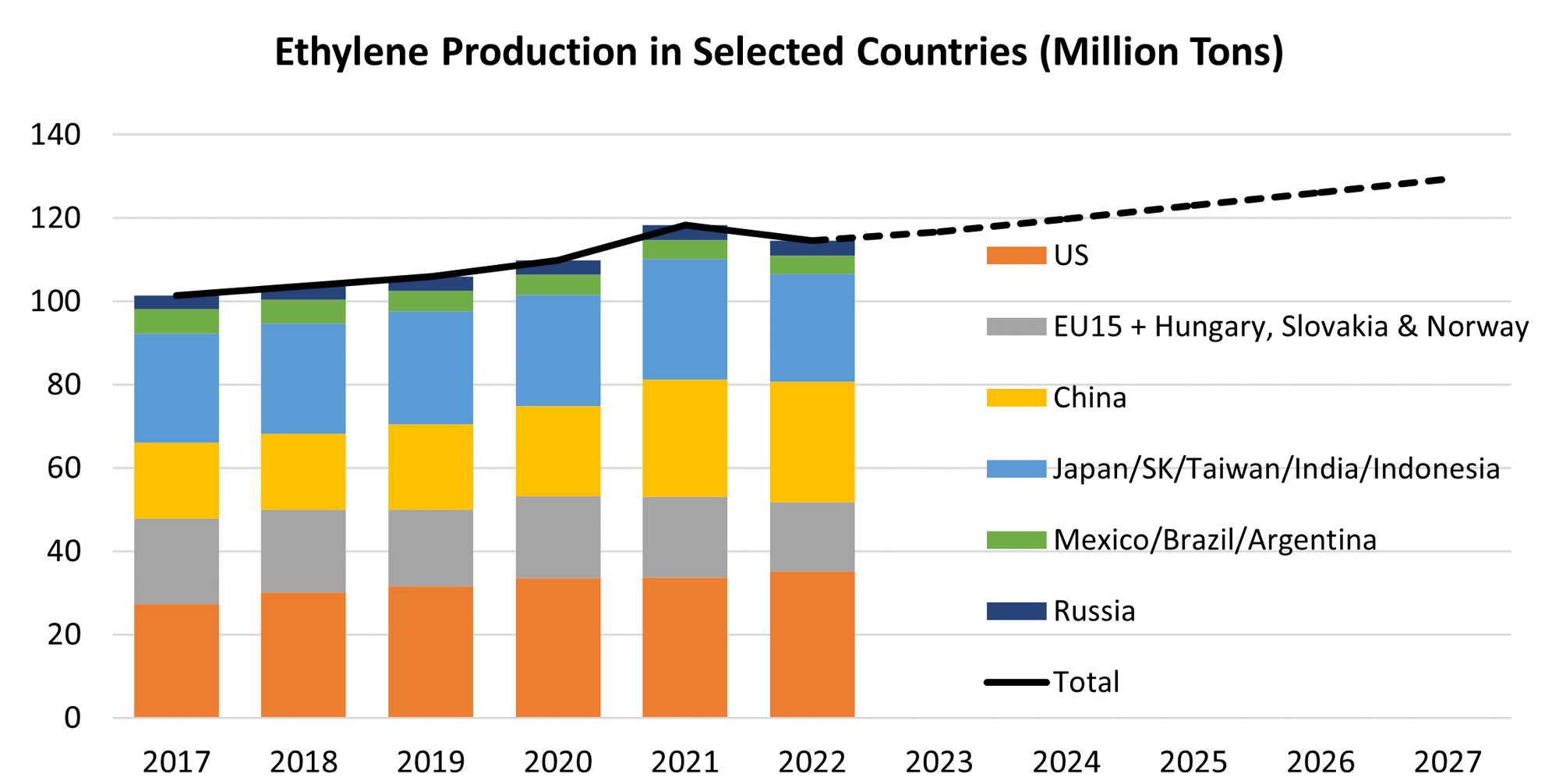

The dataset includes comprehensive supply, demand, stocks, and trade details and selected country-level data. Additionally, we incorporate monthly and annual data on ethylene production and capacity by region and selected countries, ethylene capacity, and PDH capacity by region and selected countries. The includes regularly updated lists of petrochemical projects scheduled.

What's included.

Developments in the petrochemical market for the next 12 months highlighting factors driving demand and/or supply, with occasional focus on a specific region or country.

Fundamental analysis of each feedstock considering their relative competitiveness:

Naphtha

LPG

Ethane

Dataset supporting all report aspects with country, regional data, and projections. For a full listing of table of figures, please contact us.

Benefits to you.

For companies in the petrochemical sector or whose business is impacted by the price of raw materials linked to basic chemicals, it is critical to understand the outlook for relevant petrochemical intermediates and/or the rapidly shifting dynamics of their upstream feedstocks. Leveraging our 30 years of expertise in the oil market, this report bridges developments in the oil and gas-based feedstocks and basic chemicals to help inform decision-makers on margins and opportunities in the chemical and manufacturing sector.

Sampling of headlines.

Record High Surplus Weakening Spreads

Summary: Before the pandemic, the global naphtha market normally ran a surplus below 500,000 b/d. Last year, the market was balanced thanks to strong naphtha demand driven by high petrochemical margins. In 2022, petrochemical margins have turned negative as feedstock prices surge and demand weakens for downstream consumer products due to economic headwinds. As a result, steam crackers are cutting utilization rates, slashing demand for naphtha in the petrochemical sector.

Global Naphtha & Pentanes: Record High Surplus Weakening Spreads

Low Prices Bring New Deal?

In the news.